Math Formula Xirr

Math Formula Xirr, Indeed recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will discuss about

If the posting of this site is beneficial to our suport by spreading article posts of this site to social media marketing accounts which you have such as for example Facebook, Instagram and others or can also bookmark this blog page.

Subsequent dates should be later than the first date as the first date is the start date and subsequent dates are future dates of outgoing.

Mean in math product. Xirr or the extended internal rate of return is one of the most useful formulas around yet very few know about it let alone use it. Dates required argument this is a series of dates that correspond to the given values. To convert an effective interest rate to a nominal interest rate use the following equation.

Microsoft excel stores dates as sequential serial numbers so they can be used in calculations. Values required argument this is the array of values that represent the series of cash flows. The other answers show how to implement xirr in c but if only the calculation result is needed you can call excels xirr function directly in the following way.

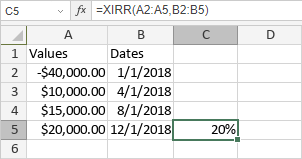

The difference is due to the fact that xirr returns an effective interest rate ie. Let us calculate xirr for above example. Xirr is the excel formula that returns the internal rate of return for a schedule of cash flows that are not regularly scheduled.

The first cash flow of each stream is the initial investment entered as a negative number. Formula xirrvalues datesguess the formula uses the following arguments. Xirr formula in excel is.

Xirr function office support see specifically the section headed remarks. Have you taken a look at microsofts official support for xirr. Instead of an array it can be a reference to a range of cells containing values.

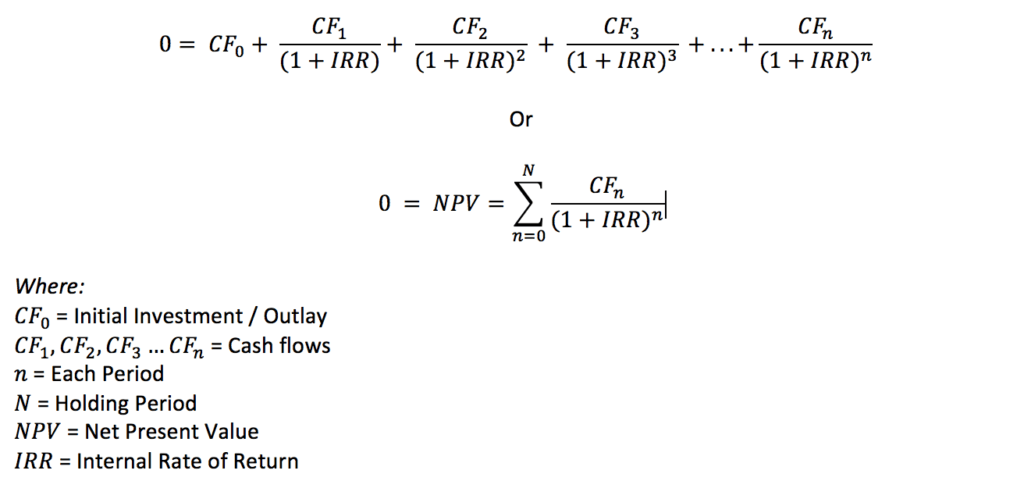

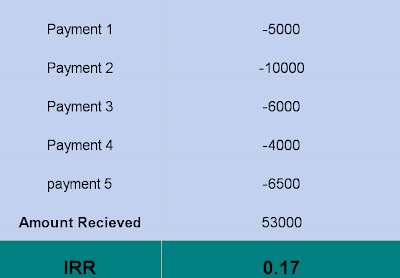

However because of the nature of the formula irr cannot be easily. To calculate irr using the formula one would set npv equal to zero and solve for the discount rate which is the irr. The invested amount and amount redeemed or current value should have opposite signs positive or negative for the purpose of calculation.

Xirr xirrvaluedatesguess values are the transaction amounts dates are the transaction dates and guess is the approximate return. If cashflow is a matrix each column represents a separate stream of cash flows whose internal rate of return is calculated. The way it is done according to xirr function support page is.

If the first value is a cost or payment it must. To calculate the internal rate of return for a series of regular periodic cash flows use the irr function. I n1r.

First add reference to microsoftofficeinteropexcel and then use the following method. The xirr function calculates in the internal rate of return for series of cash flows that occur at irregular intervals. Compounded annually which provides a mechanism for reliable comparison of interest rates.

Whereas the 75 figure i provided is a nominal interest rate. A vector or matrix of cash flows.